1

Uber drivers are aware that they have to pay taxes every quarter.

Project: Track App

feature: App Design, Branding

role: UX/UI, App Designer, Researcher

Uber drivers are aware that they have to pay taxes every quarter.

All drivers pay taxes once a year. Most drivers are unaware of the information they need to pay for every quarter.

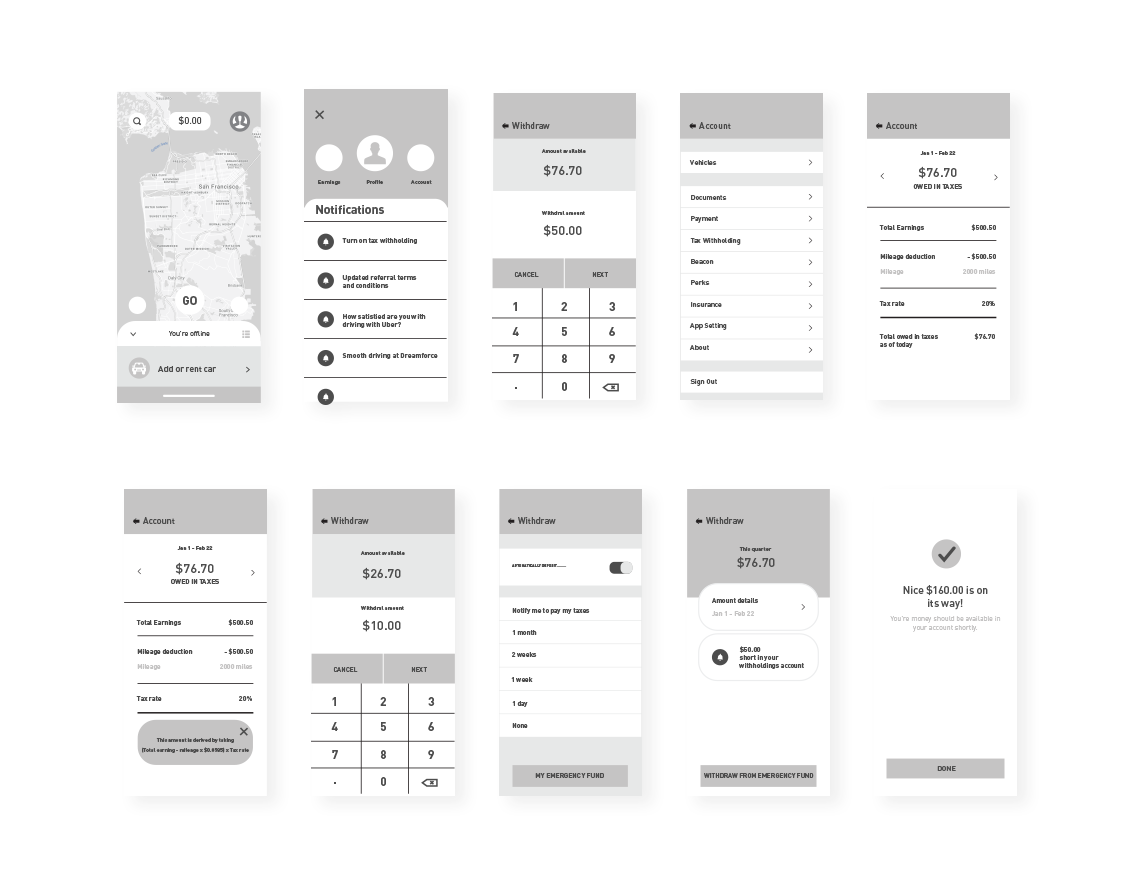

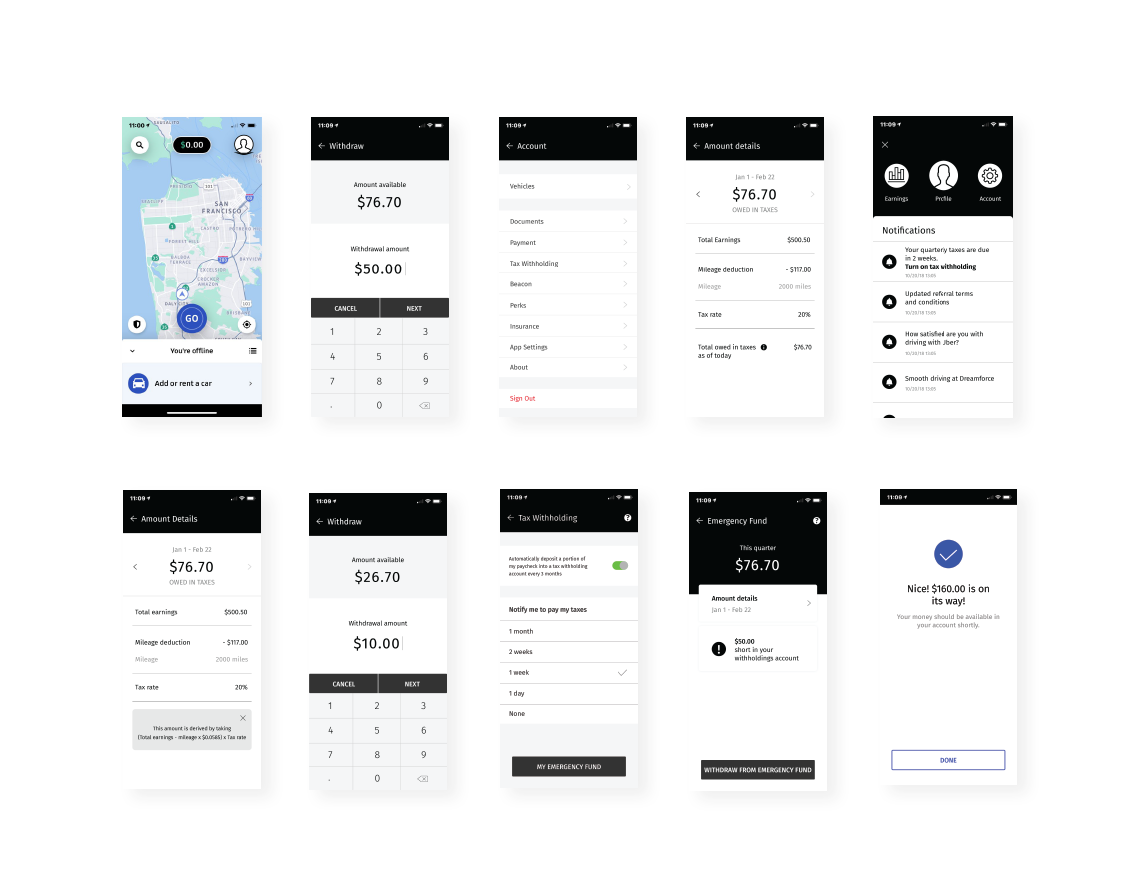

Uber drivers do their best to save on tax.

Uber drivers pay funds or get mileage deductions to save taxes. But this is only a very small number of people, and most drivers do not know about it.

Uber drivers do not know about the Tax Penalty.

Uber drivers are required to pay taxes every quarter, but this is not properly practiced. Also, they were not very aware of the penalty payouts.

Uber provides Uber drivers with information for tax purposes.

Uber drivers receive 1099form from Uber via email. But the drivers just sign and send it back. And they do not get any other information about taxes. Uber provides drivers with information about the distance they are driving and income earned from driving.

Uber drivers want to save money to pay taxes.

Most Uber drivers do not save for tax purposes.But when they think about the taxes they will pay at the end of the year, they want to save for taxes and pay taxes on savings accounts.

Uber drivers are aware that they have to pay taxes every quarter in order to avoid tax panalties.

None of the drivers knew that they had to pay their taxes quarterly in order to avoid incurring a penalty at the end of the year. All of them only paid their taxes once a year.

Uber drivers do their best to save on tax.

We found that there are some Uber drivers who do put aside some funds for taxes, while there are also others who do not even save for this, and would rather pay from their savings accounts. For the Uber drivers who do save for taxes, they simply put aside some money. However, they are often unsure if this sum would be enough to cover their taxes at the end of the year. One interesting finding was that one of our interviewees deliberately withholds more money at his W2 job to cover some if not all of his taxes owed for his Uber income.

Uber provides Uber drivers with information for tax purposes.

By providing Uber drivers with information such as how much they have earned, and how many miles they have driven in that year, Uber assists drivers in allowing them to calculate their taxes more easily.

Uber drivers are unaware that they are independent contractors.

Only one driver was under the impression that they were employees of Uber and was unaware that they were an independent contractor.

Uber drivers are unaware that they have to handle their own taxes (1099).

The majority of the drivers that I spoke to are aware that they have to handle their taxes independently, being independent contractors. One of them learned this after his first year of driving, as he thought Uber would handle his taxes the way a W2 job would.